How Appliance Financing can Save You Time, Stress, and Money.

Table of ContentsAppliance Financing Fundamentals ExplainedThe Best Strategy To Use For Appliance FinancingSome Known Details About Appliance Financing Appliance Financing Things To Know Before You BuyAppliance Financing - QuestionsWhat Does Appliance Financing Mean?Appliance Financing for Dummies

Home appliance financings are financings utilized to get new home appliances. Utilizing them can provide you some advantages over using your credit rating card. Right here are a couple of instances: - The majority of the moment, a home appliance lending will require you to make monthly payments that can be fixed or variable, depending on the structure of the car loan.

Depending upon the loan provider, you may just wait for as low as 24-hour before you get the money. This makes device loans fantastic for emergency device acquisitions. Both of these alternatives are wonderful to make use of when obtaining new home appliances. It all boils down to your demands and monetary capability.

The Only Guide to Appliance Financing

First Look Approval is a consumer financing firm that uses an actual time choice engine to both block & mortar and also shopping sellers, offering them the capability to use their customers instant funding options. Numerous borrowing programs are incorporated right into First Look Authorization's funding system, offering vendors and customers alike extra options when it concerns customer financing.

After you have actually spoken with someone from our group, you can anticipate to be enrolled right into the program within 5 service days. Depending upon the credit rating deal that your customer obtained as well as decided for, negotiation time will certainly vary according to the releasing banks' practices. For the standard program, customers are paid straight and also are ACH had actually the cash within 5 service days.

While funding times for each lender can differ, we discover that financing commonly occurs within 48-72 hours. As quickly as you are up and also running, using your login and also password, you will have the ability to access our back workplace site as well as see your purchases in genuine time. This website supplies our merchants with modern statistical evaluation tools.

Appliance Financing Can Be Fun For Everyone

Need to you choose the light integration option (the standard assimilation), First Look Approval will send you its advertising and marketing symbols, switches and banners. Simply select the symbols you like as well as include them to your site pages. For a more comprehensive as well as interactive service, you will be required to implement our API (the boosted assimilation).

You will require to add one POST phone call to send the funding request, and also carry out two postback trainers to get updates concerning lending requests and client address data.

If one of your present home appliances isn't working along with it when did, it's likely time to begin considering your choices relating to whether to repair or replace it - appliance financing. If the price to fix the concern surpasses 50% of the home appliance's value, replacing the equipment likely a smarter move. Mechanical and electrical problems prevail when it comes to devices, and numerous such issues can be fixed for $150 to $300.

Appliance Financing Fundamentals Explained

Probably the most effective time to replace your home appliances is throughout holiday sales such as those that happen on Memorial Day, Independence Day, Labor Day, Veterans Day, and Black Friday. And also one more fun time to get is when new versions get here on display room floors and the previous year's items are discounted.

What Does Appliance Financing Mean?

Financing your appliances suggests you'll have an additional costs to pay each month. Some shops might provide made use of appliance funding, yet it depends on where you are purchasing your home appliance (appliance financing). Personal loans from lending institutions or banks can be made use of to finance utilized devices. The majority of loan providers and banks do not ask what the personal financing is being utilized for so you can use it to pay for used or brand-new devices.

Whatever alternative you choose, ensure to get learn this here now a loan with low passion and reduced APR. When financing used appliances, make sure the appliance is in excellent condition as well as has a great chance of lasting for several years ahead. If you use a personal loan you must not require a deposit.

You can fund appliance repair work if you don't have sufficient money upfront to spend for the repair service. Some may favor to utilize a low APR credit rating card to fund appliance fixings. Nonetheless, you might not have a reduced APR credit report card or a limitation that is high enough to cover the fixing.

The Appliance Financing Ideas

A personal loan can be utilized to finance appliance fixings. When you use an individual financing the funds are transferred into your account and you can spend them like money. If the repair service is very pricey, some people choose to obtain a new device rather than paying to fix the old one.

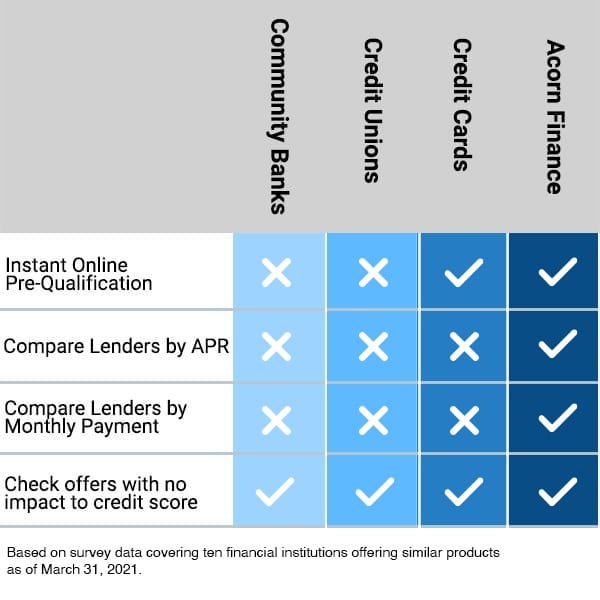

When you have actually determined how much you require to borrow, you can continue with using for financing. Use Acorn Finance to see what lenders you pre-qualify for and what kind of financings you will be able to get.

Individual loans can can be found in little or big amounts yet normally start around $1,000. You can use for a loan that is close to the amount you require from this source for the repair work. There are several loan choices for device funding, and some are much better than others. Some home appliance stores or huge retailers use internal financing or they may partner with a third event loan provider that gives the actual loan.

The 9-Minute Rule for Appliance Financing

In some cases, you may have the ability to find a retailer providing a 0% marketing funding deal. If the device shop has low-interest financing or 0% passion, this could be a good choice for funding your brand-new appliance. appliance financing. Always ask the place you are purchasing the appliance from if they have in-house funding and inspect the terms.

These are from banks, cooperative credit union, or on-line lending institutions. Individual fundings are generally unprotected, so you don't have to use a possession as security. Depending on your credit report rating and also your debt-to-income proportion, you might get a low-interest individual loan. Contact your particular loan provider to see what the passion is and also the terms for paying the finance back.